san francisco sales tax rate breakdown

After getting the assessed value it is multiplied by the mill levy to determine your property. All in all youll pay a sales tax of at least 725 in California.

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

2 days agoThe European Central Bank may potentially announce an unprecedented three-quarter-point increase in interest rates on Thursday as it tried to gain control over record inflation.

. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. Thank you for making Chowhound a vibrant and passionate community of food trailblazers for 25 years. Official Uber Newsroom for the latest company announcements in US.

Alameda enacted its own minimum wage in 2018 by city council ordinance. That rate is a uniform percentage varies by tax jurisdiction and could be any percentage below 100. More than 25 million individual visitors searched the website this year for information about the nearly 330000 parcels in the 720 square miles that make up the county with a total market value of more than 73.

Mortgage points are additional fees due at closing in the event that the buyer bought down their rate with an upfront lump sum payment. While the property tax rate can vary. If a trip begins in the UK Turo is obligated to charge more than 20 percent.

Macon County imposes a 1 tax as well. San Francisco 49ers1 Seattle Seahawks4 Narrow Further. The tax is imposed on both residents and nonresidents who work in these locations.

Although the Golden State has high taxes it does play host to a number of bustling industries. You can expect to pay sales tax of 9975 percent in this province on any service provided by Turo. News from San Diegos North County covering Oceanside Escondido Encinitas Vista San Marcos Solana Beach Del Mar and Fallbrook.

Suite 2600 San Francisco CA. 1500 to 1575 effective 7-1-2022. Maria Tadeo has a.

Turo car rental is a company based in San Francisco. They can either make a set rate or choose to vary the prices depending on the day. If you install your photovoltaic system before 2032 the federal tax credit is 30 of the cost of your solar panel system.

Calendar Forms Lookup Meet the Assessor News Photo Gallery Save on Property Taxes. The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in California. Alabama has four local taxing jurisdictions.

The company is headquartered in the Pacific Gas Electric Building in San Francisco CaliforniaPGE provides natural gas and electricity to 52 million households in the northern two-thirds of California from Bakersfield and northern Santa Barbara County almost. The minimum sales tax in California is 725. As you know when you own a property you pay property taxes.

Self-employed taxes in California just got a lot more complicated. The raw price formatted as a string 12560 formatted_with_symbol. Compare with similar items.

The final sales price from which everything else will be deducted. Excluding sales tax. The Pacific Gas and Electric Company PGE is an American investor-owned utility IOU with publicly traded stock.

Californias taxes are some of the highest in the US with a base sales tax rate of 725 and a top marginal income tax rate of 133. Two cities Bessemer and Birmingham levy an income tax of 1. The median property tax in Polk County Florida is 1274 per year for a home worth the median value of 141900.

San Francisco Bay Brand ASF65031 Brine Shrimp Eggs Vial for Baby Fish and Reef Tanks 6 grams 2 Pack. As Seen On TV15 Clearance4155. Welcome to the webpage of Oklahoma County Assessor Larry Stein.

We would like to show you a description here but the site wont allow us. AgilePM PRINCE2 Agile and Scaled Agile Framework SaFe classroom online and virtual training courses. Parameter Type Description Example.

Agile Project Management certifications accredited by APMG BCS Scaled Agile. This tax does not all go to the state though. Find the biggest sales and discounts in Stoneberrys clearance section with hundreds of items up to 65 off with new items added weekly.

Customer Questions Answers. Shipping cost delivery date and order total including tax shown at checkout. The state then requires an additional sales tax of 125 to pay for county and city funds.

Sales Price of the Property. California Sales Tax. We wish you all the best on your future culinary endeavors.

Polk County collects on average 09 of a propertys assessed fair market value as property tax. There is no applicable city tax. Three cities and one county.

Annual increases based on the lesser of 5 or the February-to-February percentage change in the CPI-U for the San Francisco-Oakland-San Jose metropolitan area. San Francisco Bay Brand. As independent contractors in California were getting a handle on how earning Form 1099 income could affect their employment status under Assembly Bill 5 AB 5 the state enacted a new law to further revise the state laws governing independent contractors.

The true state sales tax in California is 6. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. This is 30 off the entire cost of the system including equipment labor and permitting.

Annual indexing beginning 7-1-2022. The raw price as a decimal number. Heres a quick breakdown of potential costs and fees.

Gadsdens rate is 2. Florida is ranked 1055th of the 3143 counties in the United States in order of the median amount of property taxes collected.

What Is A Progressive Tax 2020 Robinhood

Sales Tax Collections City Performance Scorecards

Secured Property Taxes Treasurer Tax Collector

12 Reasons California Is A Terrible Place For Doctors To Build Wealth White Coat Investor

What Are Capital Gains Taxes For The State Of California

At What Income Level Does The Marriage Penalty Tax Kick In

3 12 16 Corporate Income Tax Returns Internal Revenue Service

How To Calculate Cannabis Taxes At Your Dispensary

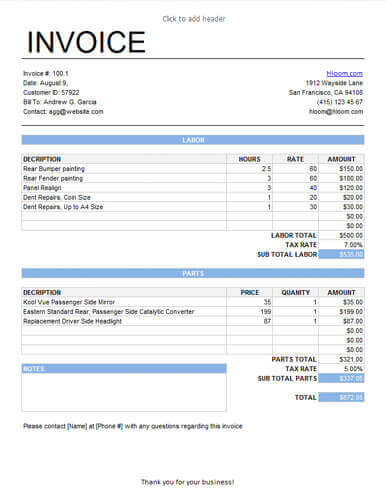

25 Free Service Invoice Templates Billing In Word And Excel

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Secured Property Taxes Treasurer Tax Collector

2022 Property Taxes By State Report Propertyshark

Property Tax California H R Block

California Cigarette And Tobacco Taxes For 2022

California Proposes 16 8 Tax Rate Wealth Tax Again Time To Move

Cell Phone Tax Rates By State Wirefly